What is an altcoin?

An “altcoin” indicates any coin that is an alternative to Bitcoin or any cryptocurrency that isn’t Bitcoin (an altcoin exchange or any major cryptocurrency exchange.

This article examines altcoins and stablecoins, their key differences and their various use cases. The article then concludes with a breakdown of several of the most popular stablecoins currently in use.

What is a stablecoin?

Stablecoins are altcoins that attempt to guarantee price stability within the crypto market. A stablecoin aims to keep its value constant, regardless of market fluctuations. The DAI stablecoin, for example, is pegged to the U.S. dollar at $1. As a result, 1 DAI is always worth $1.

Technically, a stablecoin’s market value can be pegged to any asset. Therefore, there are no “best” stablecoins, although it has become standard practice to have their value pegged to the U.S. dollar. It is also possible to link a stablecoin algorithmically to another crypto. TetherUSDT) is recognized as the first stablecoin, but there are many more.

Altcoins vs stablecoins: Key differences

The main difference between altcoins and stablecoins lies in their purpose and thus, their functionality. Because altcoins are subject to extremes in price volatility, stablecoins are intended to provide some stability as a hedge. Note that stablecoins have a fixed amount of cash reserves.

Altcoins distinguish themselves from Bitcoin by providing novel and additional capabilities, specifically by enabling access to decentralized finance (DeFi) instruments. These capabilities are possible thanks to smart contracts, and also afford faster transactions and lower fees compared to Bitcoin.

Like Bitcoin, altcoins are also subject to price volatility. The best altcoins have the potential to capture a sizable market share by improving on Bitcoin’s original consensus mechanism. As a result, they can provide massive returns on investments (ROI) for early investors.

With stablecoins, the ROI is much smaller. While stablecoin interest rates hover between 5% and 20%, these high yields aren’t the only factor that appeals to traders. Stablecoins have several advantages, including convenience (users don’t have to on-ramp fiat) and the ability to code novel design improvements into the crypto token.

While not as profitable for investors, the fixed price of stablecoins makes it crucial for cryptocurrency transactions that rely on speed for profitability.

Is Ethereum an altcoin?

In terms of trading volume as well as total value locked (TVL), Ether (Some investors object to ETH being grouped with other altcoins since Ethereum is the first blockchain with smart contract functionality, which is why BTC and ETH share the space as the two most popular cryptocurrencies in the world. Regardless, by definition, Ethereum is an altcoin.

When to hold altcoins vs stablecoins

There are advantages to holding both altcoins and stablecoins due to their different use cases. An investor may choose to maintain a portfolio with a higher percentage of altcoins versus stablecoins, and vice versa. The portfolio allocation depends on the investor’s objectives and risk tolerance as well as the state of the market.

When to hold Altcoins

Many altcoin projects are launching in the market with surprising speed. These cryptocurrencies are attractive to investors who are looking for the following features:

-

More affordable investments. Bitcoin and Ethereum, the two leading cryptocurrencies, have become prohibitively expensive. However, other cryptocurrencies with a smaller market cap tend to be more cost-friendly. Newer investors feeling intimidated by the space can begin their cryptocurrency journey in this friendlier approach.

-

Potentially lucrative returns. Investing in new or rising assets can yield quick gains. Investors who are drawn to high potential returns must monitor the more successful altcoins to buy consistently for the best returns.

-

Short-term investments. Altcoins are a good place to invest for short-term traders. Some of the altcoins to buy in 2022 are Ether (XRP), Solana (LTC), and Polygon (Reputable altcoins are traded on major cryptocurrency trading platforms like Coinbase and Binance.

What is Altcoin Season?

A growing theory is that altcoins generally perform better immediately after a Bitcoin surge. This is labeled an “altcoin season.” This trend is based on the premise that when BTC stagnates, it is time for altcoins to surge.

The period is considered an altcoin season when a majority of the top 50 altcoins have outperformed Bitcoin over the past 90-day period. Other altcoin season indicators include the following:

However, the markets can change rapidly in the crypto space and an altcoin season can’t be anticipated easily.

When to hold stablecoins

Stablecoins are often used as a hedge against inflation or to avoid the price fluctuations of cryptocurrencies. Holding stablecoins for trading and escrow is a good strategy.

Trading

Stablecoins are a popular alternative among crypto exchanges and traders who want to swap out of a volatile cryptocurrency token without converting to fiat.

When cryptocurrencies experience major price swings, investors have the option of converting some of their holdings into stablecoins, which maintain the value of their investments. Afterward, the trader can lock their stablecoins into a protocol for high yields. The trader then has the option of reconverting the stablecoins into another cryptocurrency without sustaining any losses.

Leverage

Some margin protocols like dYdX offer users the ability to use stablecoins as collateral and execute margin trades with up to 5x leverage. Doing so allows crypto traders to take up long and short positions directly from their crypto wallets, which has numerous benefits, the most obvious of which is convenience.

Some of the most popular stablecoins are MakerDAO’s DAI stablecoin, USD Coin (Why stablecoin interest rates are so high

Demand for stablecoins consistently exceeds the supply. However, stablecoin interest rates are higher than those of fiat currencies because DeFi protocols eliminate economic rents. Moreover, these protocols have to incentivize investors to provide liquidity, which explains the high interest rates. (As the TVL of these protocols increases, the rates should decrease in tandem.)

Cryptocurrency exchanges requiring stablecoin liquidity offer high interest rates to attract new lenders. Since stablecoins maintain their pegged value, trading platforms are willing to offer users higher interest rates for them.

For other altcoins, exchanges tend to offer lower interest rates due to their high price volatility, making them a riskier store of value. Interest rates on a cryptocurrency like ETH range from 5% to 8%. In contrast, stablecoins often command interest rates of roughly 10% or more.

How to use stablecoins as a hedge against inflation

Inflation is a major problem for fiat currencies. The value of the U.S. dollar, the euro or even the Japanese yen depends on the fiscal policy decisions of their respective governments and central banks.

The value of a nation’s currency also depends on public trust. (“Fiat” literally means “It shall be” in Latin, as in, the value of a nation’s currency is in accordance with what its government determines it to be.) A currency may become worthless if people lose faith in the government that issues it. Since many of the world’s fiat currencies suffer from excessive inflation, they hold little value against stronger currencies.

Stablecoins hedge against inflation in the following manner. Traditional banking processes may make it difficult to convert a depreciated local currency into a stable international currency.

Stablecoins, however, allow anyone with internet access to purchase a 1:1 fiat-equivalent asset from anywhere in the world. The tokens are designed to price-match their designated currency at all times. Therefore, a USD-based stablecoin always adjusts its peg to match its value to that of the U.S. dollar.

These stablecoins can be held through highly volatile periods and can be traded for cash as necessary. As a result, stablecoins allow individuals to preserve their purchasing power with minimal restrictions.

How stablecoins hedge against crypto market volatility

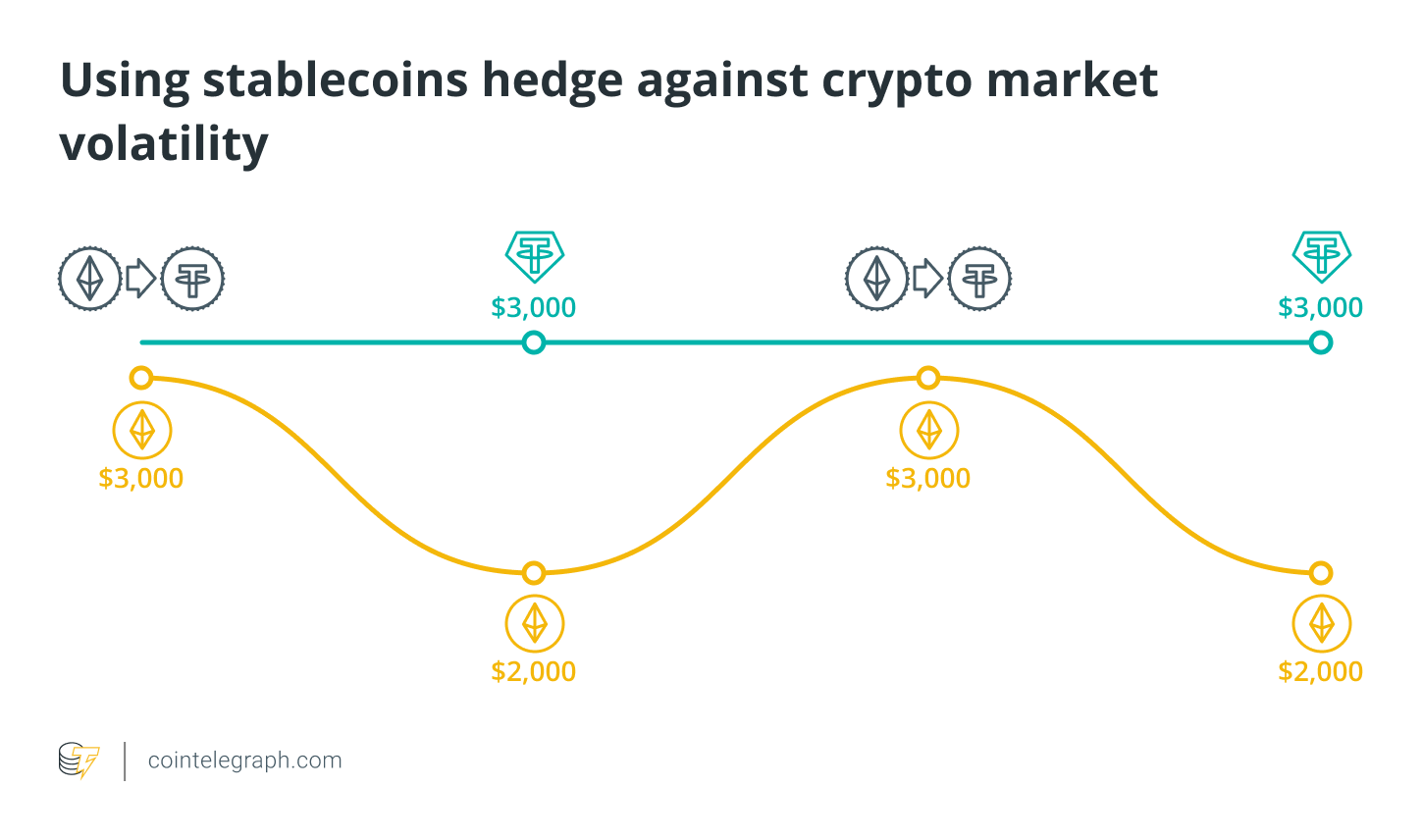

Let’s understand how stablecoins can be used to hedge against crypto market volatility in the following example:

Assume ETH is trading for $3,000. However, due to price fluctuations, the value drops to $2,000 every few days. To protect against losses, traders can trade their Ether for a stablecoin by exiting near ETH’s peak. They can thus purchase 3,000 units of USDT at $1 each. This way, they still maintain $3,000, even when ETH is back to trading at $2000. At this point, investors can choose to buy back in.

Issues with stablecoins

Are stablecoins backed by their USD equivalent in a real-life vault somewhere? This has been a question surrounding stablecoins. To guarantee a $1 peg per coin, fiat-backed stablecoins require financial reserves back the digital asset in real life.

External audits of the funds are required to ensure transparency. However, cryptocurrencies are largely unregulated. Fiat-pegged stablecoins have come under scrutiny since analysts believe that several prominent stablecoin projects may not have the funds to guarantee the value of their tokens.

Tether (USDT)

Once again, Tether reversed course in April of 2019 and claimed to be backed by 74% of “cash and cash equivalents.” Then, in February 2021, the company formally agreed to pay an $18.5 million fine after the New York Attorney General’s office began looking into the company’s claims. As part of the settlement with the New York Attorney General’s office, Tether released an attestation of its collateral.

The information they published shows that only 2.9% of the underlying assets are cash. Even so, this in no way constitutes a formal audit, and these figures have yet to be independently verified by a reputable auditing firm.

USD Coin

Some traders and investors use USDC instead of USDT. USDC has been adopted by financial institutions such as Visa and Moneygram. Circle, its parent company, has also raised capital from notable companies like Fidelity, Marshall Wace and Bloomberg.

Although USDC is also pegged to the dollar, the stablecoin is more transparent than Tether, making it a more dependable asset-backed stablecoin for traders and investors. Each month, Circle releases an independent attestation of its dollar reserves. These attestations are signed off by Grant Thornton LLP, the sixth-largest accounting firm in the United States.

However, an analysis revealed that only around 60% of USDC is backed by cash and cash equivalents. The remainder of assets comprises a mixture of short- and long-term debt instruments such as bonds and U.S Treasury bills.

MakerDAO’s DAI stablecoin

With debt-backed stablecoins like USDC, volatility is minimized, but the risk of a total loss of value is amplified. This is less likely with algorithmic, crypto-backed stablecoins like DAI. Algorithmic stablecoins keep prices consistent by controlling their supply.

When the token’s price falls too low, algorithmic stablecoins buy back tokens to shrink the supply, thus creating scarcity. On the other hand, when prices rise too high, new tokens are minted for sale to expand the supply.

The DAI stablecoin automates this process with Ethereum smart contracts. Using an algorithm is more cost-effective than maintaining reserves. However, in times of significant market volatility, the algorithm may not be able to function optimally, and hence, the stablecoin’s price may fluctuate as well, creating arbitrage opportunities.

Altcoins vs stablecoins: Key takeaways

Although altcoins are important assets for cryptocurrency investors, they experience significant price fluctuations. An altcoin may lead to a 10x return on investment, but it could crash just as quickly. Moreover, the market for altcoins has become saturated with low-quality projects.

In comparison, stablecoins limit losses, but they are not without controversy. Many question whether leading stablecoin projects can maintain their stated value during periods of extreme market volatility. Whether users should invest in altcoins or stablecoins depends on several factors, including risk tolerance and the overall objective of their portfolio.

Alternatively, advanced investors may choose a combination of both to achieve a delta-neutral portfolio and minimize losses.